In the world of online business and finance, equity is the value of ownership in something. Equity can be used to measure the value of an entire business, a single stock issued by a business, the complete product owned by the business, or any other thing that has value. That’s why equity matters to business owners, investors, and even customers who choose between products.

Here how it’s done:

- What is Equity?

- Formula for Equity

- Types of Equity

- Benefits of Equity

- Conclusion

What is Equity? 🤝

Equity is the measure of capital invested or owned by the owner of a company. The equity is calculated by the difference between liabilities and assets recorded on the balance sheet of a company. The value of equity is based on the present price of the share or a value regulated by the valuation professionals or investors. This account is also known as stockholders or owners or shareholders equity.

The term equity also used to refer to the pursuit of justice, usually in the context of social issues like gender or race. This definition has no connection to equity as a measure of value, but both terms used in business settings. For example, a company can alter its recruitment policies in an effort to achieve greater racial equity during the hiring process.

While equity is the most often used context for investing and analysing balance sheets, it can be applied to any type of ownership. Another common use of equity applies to homeowners just like other businesses homeowners can calculate their home equity by assessing the value of their property and subtracting any remaining balance on their mortgage.

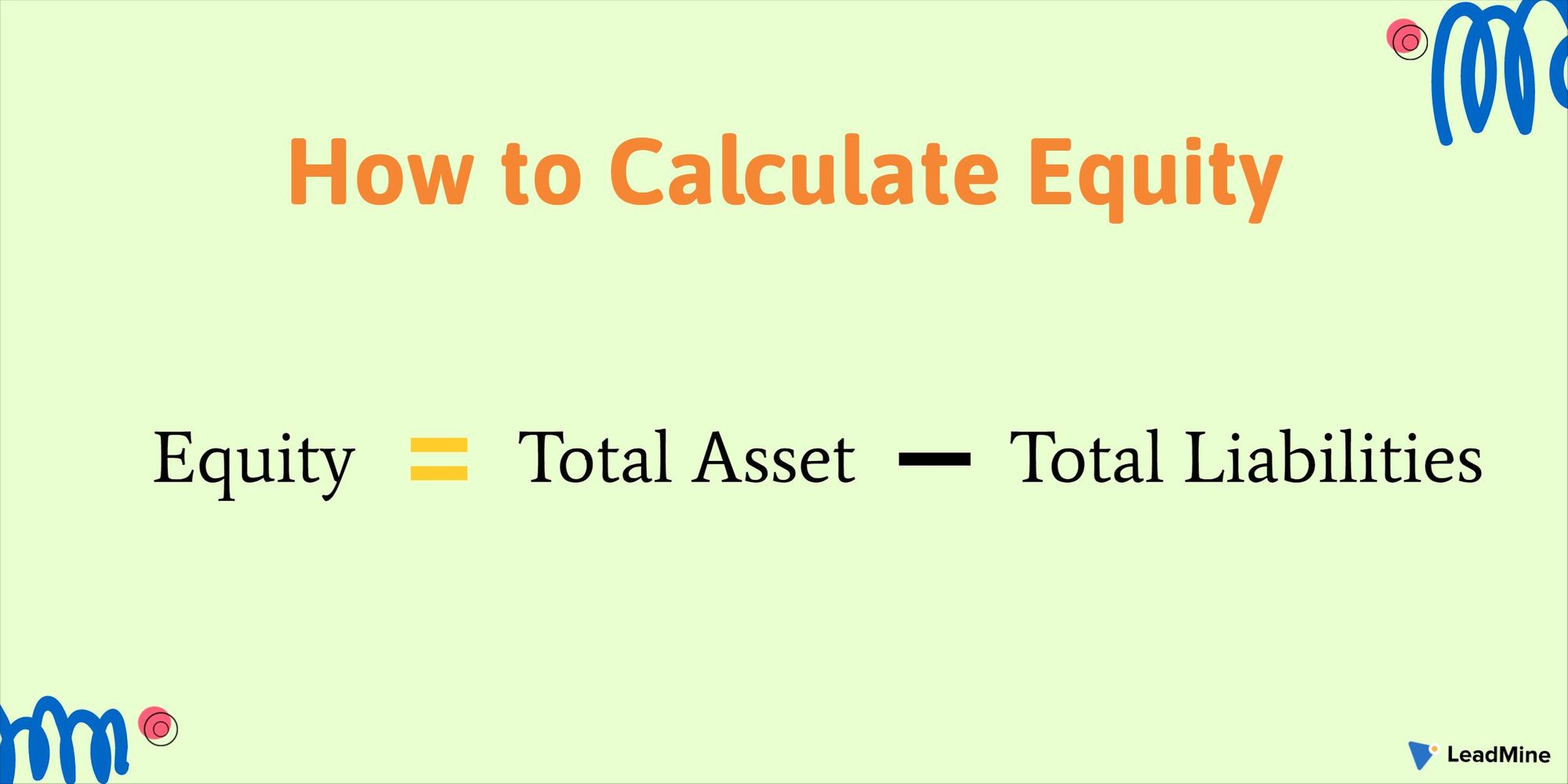

Formula for Equity 🤓

The following formula can be used to determine the equity of a company that derives from the accounting equation.

Equity = Total Asset – Total Liabilities

The data can be found on the balance sheet, where these four steps should be followed:

- Determine the company’s total assets on the balance sheet for a particular period

- Determine total liabilities and list them separately on the balance sheet

- Subtract total liabilities from total assets to arrive at equity

- Assets equal to the sum of liabilities and equity

Equity can also be expressed as a firm’s share capital and retained earnings less the value of treasury shares. This method is less common but both methods yield the same figure. The use of total assets and liabilities is more illustrative of a firm’s financial health.

Types of Equity ✌️

There are generally two types of equity:

1. Book Value of Equity

In finance, equity is listed at its book value. The value that accountants calculate by preparing financial statements and the balance sheet equation.

The equation is,

Assets = Liabilities + Equity

Also can be rearranged to,

Equity = Assets – Liabilities

The asset value of a company is the sum of each current and non-current asset on the balance sheet. The asset accounts are cash, fixed assets, accounts receivable, prepaid expenses, inventory, property plant and equipment, intellectual property, goodwill, and intangible assets.

The value of a company’s liabilities is the sum of each current and non-current liability on the balance sheet. Common liability accounts are accounts payable, long-term debt, short-term debt, lines of credit, capital leases, deferred revenue, and any fixed financial commitment.

The value of equity is measured in a much more detailed way and is a function of shared capital, contributed surplus, retained earnings, net income, and dividends.

2. Market Value of Equity

In accounting, equity is expressed as a market value that may be higher or lower than the book value. The reason for the difference is that accounting statements are backward-looking while financial analysts are forward-looking which means to the future, to forecast what they believe financial performance will be.

If a firm trades publicly, the market value of its equity is easy to measure. It is simply the latest share price multiplied by the total number of shares outstanding.

If a firm trades privately, the market value much harder to determine its market value. If the company needs to be formally valued, it will hire professionals such as investment bankers, accounting firms, or boutique valuation firms to perform an analysis.

Factors affecting the market value of equity:

- Number of Market Contenders – If the number of investors, traders, analysis increases, the market becomes more comprehensive and competent

- Availability of New Information – Updates like expansion, new product production affects the financial status of the company. So it also affects the price of the company’s share that eventually influences the market value of the company

- Circular Factors – Market value keeps changing and affects the market value

- Government Interference – This interrupts the market value of many companies. However few countries prohibit foreign people to trade in their market. So the market value of these companies in such a closed market can’t expand as compare to other open markets.

Benefits of Equity 😇

There are several advantages that an individual can benefit from by investing in equity. Some of them are:

- High Returns

Investing in equity provides high returns to investors and shareholders. They have an opportunity to enjoy wealth creation, not just through dividend earnings but also through capital appreciation. - Provides a Cushion against Inflation

When an individual invests in equity, they have the potential to earn high returns. The rate of returns earned is higher than the rate of wearing down of the investor’s purchasing power due to inflation. So investing in equity acts as a hedge against inflation. - Ease of Investment

Investing in equity is simple and can avail the service of a stockbroker or financial planner to invest through various stock exchanges in a country. If an individual has a Demat account, they can buy the stocks in a few minutes. An investor chooses to invest via NSE or BSE equity or the likes, they can enjoy the ease of investment. - Diversification of Investment Portfolio

Investors choose to stick to debt instruments since they are low-risk investment options owing to lower volatility. Although, debt instruments may not always generate high returns that is why individuals can diversify their investment portfolio by investing in equity for higher returns.

Summary

Equity is more suitable for investors who are willing to take a risk with their investments. Those who are constrained by time or experience in the money market can also lean towards equity mutual fund investments for moderate to high returns. However, it is important for investors to gauge their risk appetite before investing in the equity market to make sure that they make sound financial decisions.

Share your thoughts about equity with us at LeadMine.