Business owners and marketers are constantly searching for opportunities to increase sales by acquiring new customers and improving established consumer relationships at the lowest possible cost. Understanding how to measure a customer's lifetime value (LTV) is critical to maximizing the return on investment in marketing, product growth, and customer service.

We will cover the following:

- What is Lifetime Value?

- How to Calculate Lifetime Value?

- Why Lifetime Value is Important?

- What Factors Contribute to Lifetime Value?

- How to Increase Lifetime Value?

- Conclusion

What is Lifetime Value? 🤔

The Life Time Value (LTV) is an estimation of the total revenue that a customer can receive over the course of their relationship. This customer's "worth" will help a business make several economic decisions, such as marketing budget, capital, profitability, and forecasting. It, along with MRR (Monthly Recurring Revenue), is a significant metric in subscription-based business models.

It is possible to quantify the value of a customer to a corporation over the period of time that they were affiliated with them by comparing the LTV of a company to the cost of customer acquisition. The LTV assists a business in attracting and retaining highly valued clients.

If a company can accurately predict a user's lifetime value, it gives advertisers a much stronger foundation on which to make decisions, allowing them to optimize the efficacy of their advertising budget. Customer lifetime value (CLV or CLTV) and lifetime customer value (LCV) are other terms for LTV.

How to Calculate Lifetime Value? 🤓

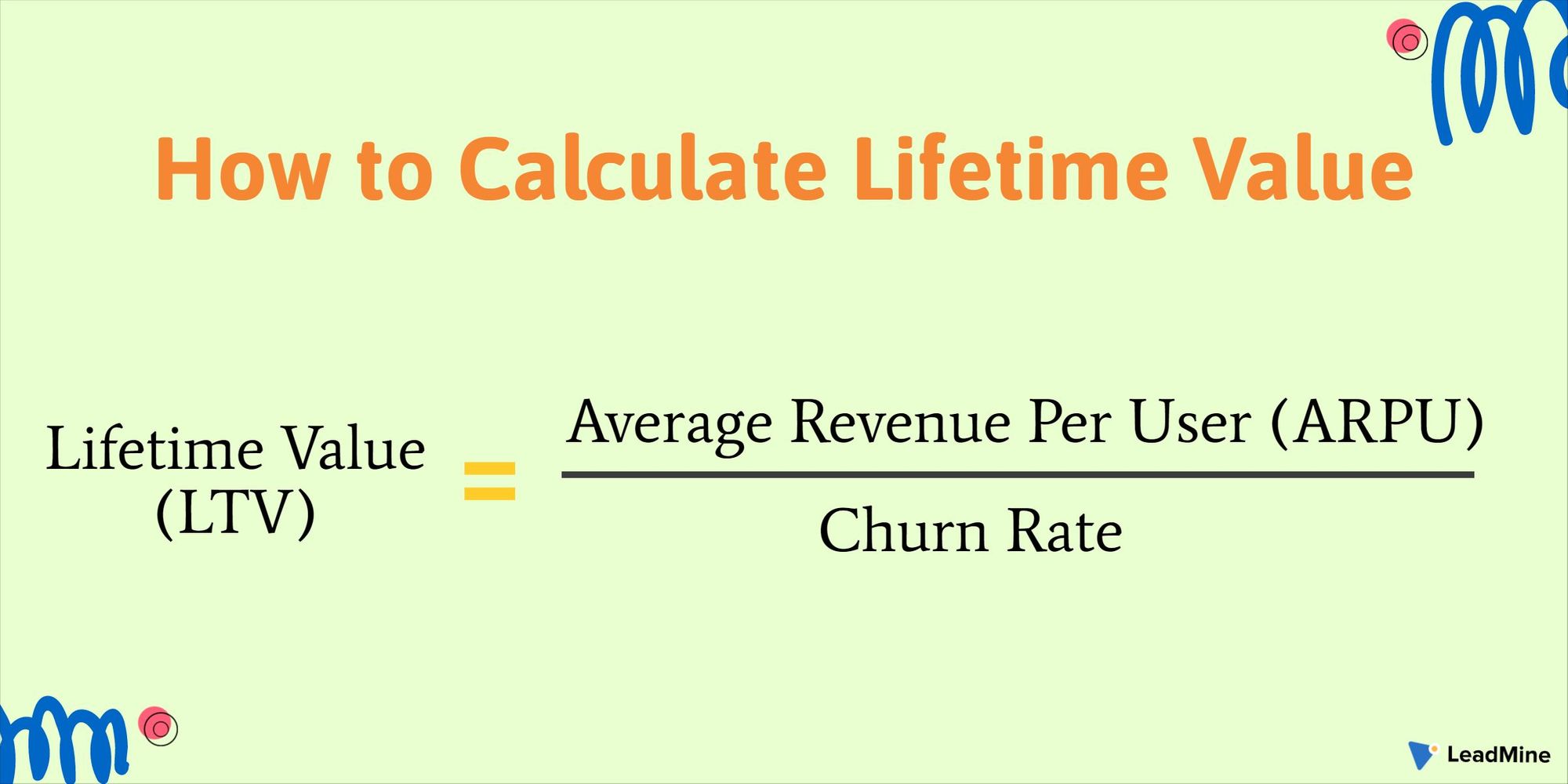

There are several methods for calculating lifetime value. In the case of a subscription model, dividing the average monthly amount expected from each customer by the churn rate.

The formula determines a user's lifetime value by estimating how much money they'll make over a given duration (ARPU, or Average Revenue Per User) and how well they return (1/churn). You may use this method to estimate how much a consumer is worth over the course of their time on an application.

It is the overall revenue you expect to earn from a new client, plus any add-ons and/or upsells you expect from the customer, for businesses that use a non-subscription model. The Average Order Value is multiplied by the number of Expected Purchases and the Time of Engagement to arrive at this figure. As a result, depending on the products and willingness to grow the account, a customer's LTV will grow or shrink over time.

It's important to remember that different types of customers have different LTVs, particularly if your various products have different pricing levels. In this situation, calculating the LTV for different customers depending on the pricing group they fall into makes more sense.

Why Lifetime Value is Important? 😓

Each new customer brings additional revenue per month and over their expected ‘lifetime'. So Lifetime Value is a key variable in revenue forecasting.

LTV may also be used to calculate a company's marketing budget. Adding LTV segments to your customer personas will help you gain a deeper understanding of each customer's value. Customer Acquisition Cost (CAC), or the cost of attracting one new customer, should always be lower than the Lifetime Value of a new customer for each segment.

LTV can be used to allocate resources to existing customers. If you've figured out how to segment your customers based on their LTV, you'll be able to devote more time to customer acquisition and retention. Customers with a high LTV should be given more support based on where they are in the customer lifecycle, particularly if they are approaching the end with the possibility of renewal.

What Factors Contribute to Lifetime Value? 🧐

The popularity of a brand among consumers determines a business's lifetime value. For example, if a consumer has no brand loyalty and does not incur any switching costs when purchasing a competitor's product, the company's lifetime value will suffer. A company's LTV is influenced by the following factors:

Factor 1: Churn Rate

The churn rate is the percentage of customers who quit shopping at a company after being loyal for a long time. The rate varies by sector and is determined by the company's competitive advantage and ability to keep consumers interested in their goods. Small companies and start-ups, on the whole, have a high turnover rate.

Factor 2: Brand Loyalty

It determines how loyal consumers are to a company and how often they purchase their products and services. Building brand loyalty can assist in customer retention and lowering the churn rate. A business with a large number of loyal customers would have a high lifetime value.

How to Increase Lifetime Value? 😊

Reduced turnover would boost the company's long-term profitability by increasing the LTV of new customers. To minimize turnover, it is recommended that you have a retention plan targeted to different LTV segments.

Here are a few LTV best practices to consider:

#1 Good Communication

Open communication between the company and the consumer will improve a customer's relationship with the brand. It is important for businesses to pay attention to customer feedback because it will help them evolve and develop. Effective communication often lowers the churn rate.

#2 Re-engage Customer

Engaging with consumers who have already bought products and services from the business is an important way to raise LTV. It is especially beneficial to companies with a long shelf life, and it can aid in brand awareness.

#3 Increase Brand Loyalty

A company's lifetime value will help with future growth forecasts and profitability. Increased LTV can be achieved by incorporating brand loyalty initiatives.

#4 Enhance the Onboarding Process

Your customer LTV may be lower than it should be because new customers find your product difficult to understand and use. Customers who become disappointed the first few times they attempt to learn about your product are less likely to stick with it for long.

#5 Provide Outstanding Support

Many companies even jeopardize their LTV by failing to offer outstanding customer service. Making sure the staff is available to assist customers when they need it is an important strategy for establishing a long-term partnership with them. This is why it's important to ensure that the customer service is top-notch.

#6 Surprise and Delight Your Customers

Finally, give the customers something good that they aren't expecting on a regular basis to increase average LTV. You may want to upgrade long-term customers to a higher-level service or inform them that you're offering them free use of a new widget you're selling to new customers.

Conclusion

You can use LTV to figure out how much your goals are worth. This is accomplished by decomposing a customer's Life Time Value and assigning values to each micro and macro conversion along the funnel.

Instead of assigning values based on the first conversion, you'll be able to get a more accurate picture of the value of each conversion metric in terms of your customer's LTV if you do it this way. This approach also makes it easier to break down your CAC by funnel point, making it easier to build a precise marketing budget.

So share your thoughts about Lifetime Value with us at LeadMine.