Monthly Recurring Revenue is one of the most important metrics a SaaS company can track. You're essentially based on the almighty MRR metric to calculate the growth or fall. After all, the ability to produce and sustain a profitable MRR underpins the entire subscription-based business model.

Here how it’s done:

- What is Monthly Recurring Revenue?

- How to Calculate MRR?

- Why Calculating MRR is Important?

- Types of MRR

- Summary

What is Monthly Recurring Revenue? 🤔

Monthly recurring revenue (MRR) is a financial measure that depicts the revenue a business expects to obtain from consumers on a monthly basis in exchange for delivering products or services. MRR is a metric that calculates a company's normalized monthly sales. For businesses that offer a variety of pricing plans for their products or services, revenue normalization is important.

MRR is a figure that represents a company's recurring monthly sales on an annual basis. Software-as-a-Service (SaaS) businesses that depend on a subscription-based revenue model often use it. It's a method of combining all of your different pricing plans and billing periods into a single, consistent number that you can monitor over time.

Despite the fact that MRR is not recognized by accounting principles such as GAAP or IFRS, investors continue to monitor it. Investors can easily assess a company's growth by examining its MRR pattern from month to month. As a result, the metric is reported in most public corporations' quarterly and annual reports that use a SaaS business model.

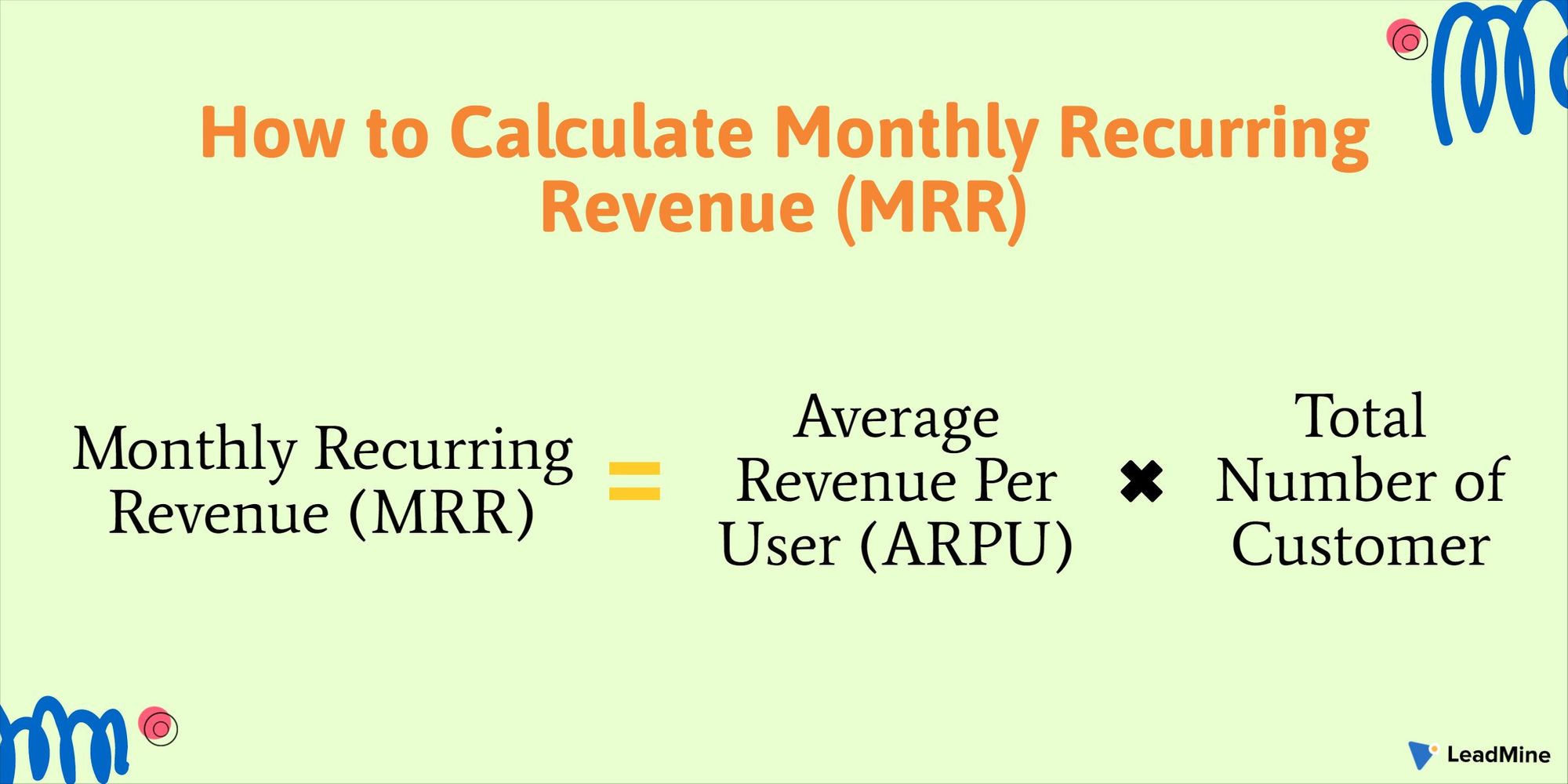

How to Calculate MRR? 🧐

The MRR calculation is straightforward. You must multiply the monthly average revenue per user (ARPU) by the total number of customers.

MRR = Average Revenue Per User (ARPU) x Total Number of Customer

For subscriptions under annual plans, MRR is determined by dividing the annual plan price by 12 and multiplying the result by the number of customers on the annual plan.

Why Calculating MRR is Important? 🙄

MRR offers insights into what leaps you can take to expand your business by providing an accurate image of how much sales potential your company has. Let's take a look at what else MRR can do for you and why it's such an essential subscription metric.

A month is considered a suitable time frame for measuring the growth of a subscription company. A week is far too short, and a year is far too long to wait to see how the company is doing. Furthermore, unlike one-time purchases, where full payment is made at the time of purchase, revenue for a given customer is trickled in by small amounts per month in the subscription model.

To create a sustainable company, you must calculate your business output similarly, ensuring that you will have a consistent cash flow every month. That's where MRR comes in handy. It keeps track of month-to-month trends and offers short-term insights into the company's financial success, allowing you to see how close you are to meeting your sales targets for the year. You can also use your finances to help you set reasonable potential targets by looking back on the previous year.

MRR is thought to be essential for making accurate revenue forecasts and preparing for both short- and long-term market expansion. You can forecast next month's revenue and determine what adjustments you need to make in your sales activities to improve revenue by reviewing your monthly financial results.

MRR forecasts the amount of money that will come through the company each month. When you combine this income with the company's costs, you get an accurate picture of the money you'll have available to reinvest in the company. This is how MRR assists you in making reliable decisions and budgeting for business expansion with confidence.

Types of MRR 🙄

MRR creates a connection between customers and their accounts, allowing you to see how they use their subscriptions. A rise in MRR means that customer acquisition, plan updates, or both have increased. Increased downgrades, cancellations, and churn rate indicate a decrease in MRR.

To understand the precise reasons for MRR's rise and fall, you'll need to monitor the various factors that influence this metric separately. When you break down the MRR into more basic categories, you'll find that each one provides unique insights into sales, customer conduct, and company health.

- New MRR

The additional revenue created from new customers acquired during a month is referred to as new MRR. - Upgrade MRR

Over the course of a month, upgrade MRR is the amount of additional revenue created by subscriptions that switch from existing pricing plans to higher plans. When calculating Upgrade MRR, the add-ons associated with the subscriptions are also taken into account. - Downgrade MRR

Downgrade MRR is the monthly income from subscriptions that have been downgraded from their current package to a lower plan. - Expansion MRR

The extra revenue earned from current customers in a given month relative to the previous month is known as expansion MRR. Expansion MRR generates additional revenue by add-ons, upselling, and cross-selling. Expansion MRR that is positive means you were able to keep your customers by obtaining their satisfaction and loyalty. This is beneficial to the bottom line because these sales to current customers have no Customer Acquisition Cost (CAC). - Reactivation MRR

The monthly revenue created by previously churned customers who return to a paid plan is referred to as Reactivation MRR. It denotes the benefit made from regaining lost customers. - Contraction MRR

The sum your company loses due to subscription cancellations and downgrades within a given month is known as contraction MRR. If a customer cancels their subscription, downgrades to a lower-priced package, pauses their subscription, uses credits, receives a discount, or avoids a recurring add-on, you'll have Contraction MRR. While some contraction MRR is due to downgrades, contraction MRR differs from downgrade MRR in that other factors play a role. - Churn MRR

The cumulative amount your company loses due to subscription cancellations over a given month is referred to as churn MRR. - Net New MRR

The net new MRR shows how much your income has increased (or decreased) in the last month relative to the previous month.

Summary

Like that of most subscription-based SaaS businesses, your performance is determined by your ability to create a sustainable MRR. It's critical to not only monitor and evaluate your MRR but also to interpret and react to any changes in your recurring revenue. Use your knowledge of this information to keep a close eye on your company's trajectory in the months and years ahead to ensure it continues to grow.

So let us know what you think about Monthly Recurring Revenue (MRR) at LeadMine.