The process of fund accounting produces net asset value as well as other accounting and recordkeeping tasks. Fund accounting systems are complex computerized systems that track investor cash flows into and out of a fund, investment purchases and sales, and investment income, profits, losses, and operating expenses.

Here we will cover the following:

- What is Net Asset Value?

- How to Calculate Net Asset Value?

- Why Net Asset Value is Important?

- Net Asset Value vs Market Price

- Conclusion

What is Net Asset Value? 🤔

The value of a fund's assets minus the value of its liabilities is known as net asset value (NAV). The term "net asset value" is frequently used in the context of mutual funds, and it refers to the value of the assets owned in the fund. Mutual funds and Unit Investment Trusts (UITs) are required by the Securities and Exchange Commission (SEC) to compute their NAV at least once every business day.

The market value per share of a mutual fund is represented by the Net Asset Value. It is computed by subtracting the liabilities from the total asset value and dividing the number of shares by the number of shares. To get the price of each fund unit, take the portfolio's market value and divide it by the total number of current fund units.

In simple terms, net asset value is the price you pay for the mutual fund scheme's units. Mutual fund units typically start at $10 and climb in price as the fund's assets under management increase.

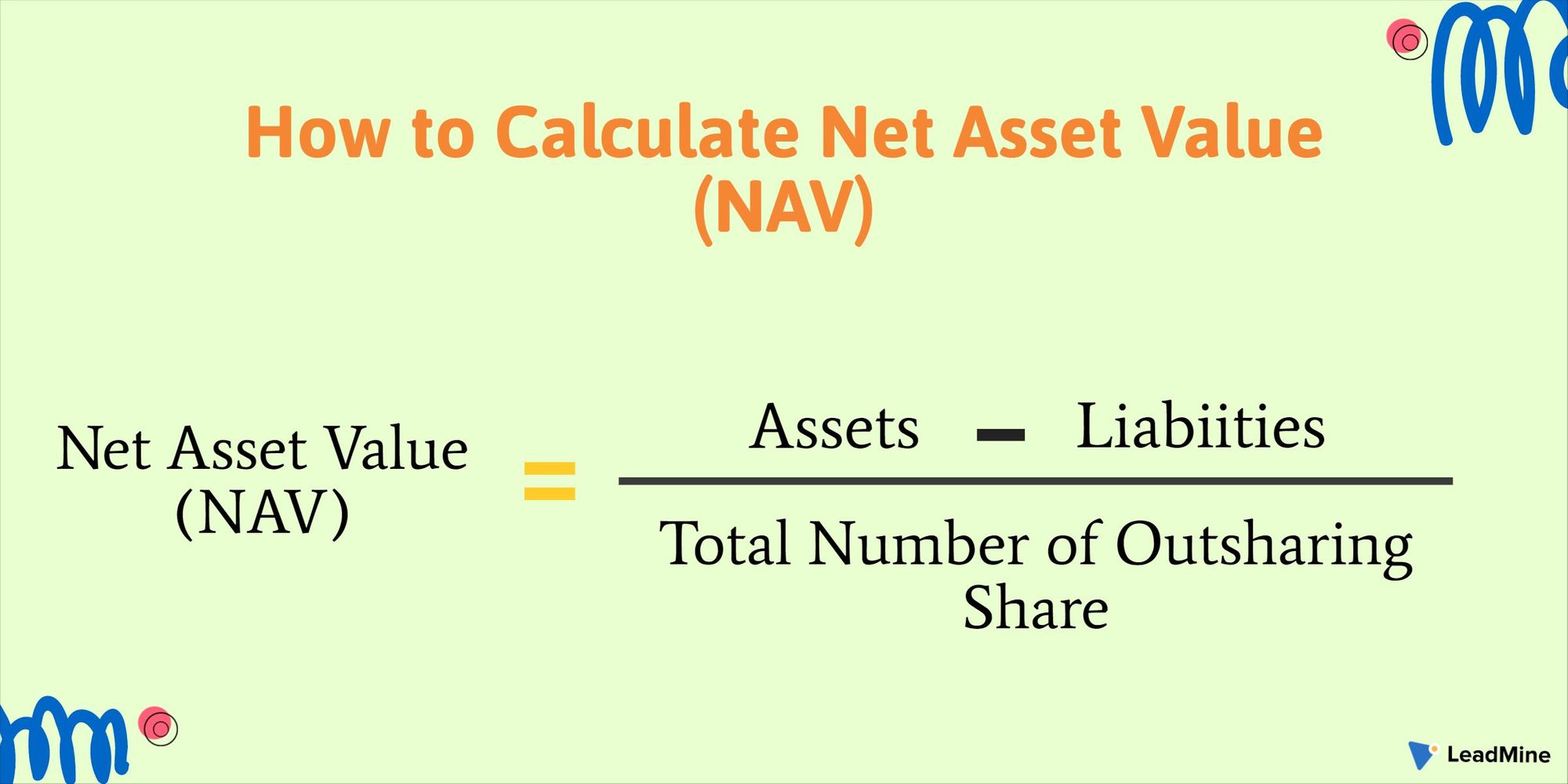

How to Calculate Net Asset Value? 🧐

The net value can be calculated in a number of ways. It's simple to do using the formula below -

Net Asset Value = Asset – Liabilities / Total Number of Outstanding Shares

However, in order to obtain an accurate net value of assets, it is critical to enter the correct qualifying items under assets and liabilities.

Why Net Asset Value is Important? 🙄

Net Asset Value is the price at which mutual fund units are bought and sold, although it is not the same as the market price of a stock. Investors in the stock market determine the stock price based on the company's fundamentals, future prospects, and other factors.

As a result, the market price of a stock may differ from its book value. Investors do not determine the NAV. It refers to the overall value of the scheme's portfolio.

Deciding to invest based on a scheme's NAV is not a good idea. The NAV of two mutual fund schemes cannot be used to predict their future performance. NAV, as you may know, is the total worth of a scheme's investments with fewer obligations and expenses.

Thus, a greater NAV simply indicates that the scheme's investments have performed admirably. Or the system has been in operation for a long time.

The NAV has no bearing on the number of units you may receive. If you choose a scheme with a high NAV, you will receive fewer units, but the value of your investment will remain the same. It is the mutual fund scheme's performance and returns that are important.

Net Asset Value vs Market Price 🥊

It's possible that a mutual fund's Net Asset Value (NAV) differs from the market price of a share. The market price of a share is determined by demand and supply, as well as analyst predictions for the company's future success.

You have a mutual fund demand that is not determined by the Net Asset Value (NAV). You buy mutual fund units at their current book value. At the end of the trading day, the Asset Management Company (AMC) will decide the NAV. It takes into consideration all of the underlying securities in the mutual fund scheme's closing market values.

A mutual fund raises money from a large number of investors. It then invests the funds' collected capital in a variety of equities and other financial products that meet the fund's investment objectives. Each investor receives a certain number of shares in proportion to the amount they contribute, and they are free to sell their fund shares at any time and pocket the profit or loss.

Because regular buying and selling (investment and redemption) of fund shares begins following the fund's debut, a system to price the fund's shares is required. NAV is the basis for this pricing method. As a result, if a mutual fund's NAVPS changes, so do its price.

Unlike stocks, which change in price with each passing second, mutual funds do not trade in real-time. Mutual funds, on the other hand, are priced using an end-of-day formula based on their assets and liabilities.

The total market value of a mutual fund's investments, cash and cash equivalents, receivables, and accrued income are all assets. The fund's market value is calculated once per day using the closing prices of the securities in its portfolio. Because a fund's capital can be in the form of cash and liquid assets, the cash and cash equivalents category is used to account for that portion of the fund's capital. Receivables include payments such as dividends or interest due that day, whereas accrued income refers to money a fund has earned but has yet to receive.

Money owed to lending institutions, outstanding payments, and a range of levies and fees payable to other connected entities is often included in a mutual fund's liabilities. A fund may also include foreign obligations, such as shares issued to non-residents, income or dividends that are pending payment to non-residents, and sale proceeds that are pending repatriation.

Depending on the payment horizon, such outflows can be classed as long-term or short-term liabilities. Accrued expenses, such as staff wages, utilities, operating expenditures, management expenses, distribution and marketing charges, transfer agent fees, custodian and audit fees, and another operational costs, are included in a fund's liabilities.

All of these different elements falling under assets and liabilities are taken as of the end of a certain business day to compute the NAV for that day.

Conclusion

The Net Asset Value is just a representation of how the underlying assets have performed over time. As a result, investors should not use it as a criterion for selecting funds to invest in. To make an informed decision, they should examine the returns on their assets.

The Net Asset Value is valuable in determining how a fund performs on a daily basis. It doesn't tell you how profitable a fund is. Thus, before investing in a mutual fund, investors should look at the current cost of the fund as well as its past performance.

So share your thoughts about Net Asset Value (NAV) with us at LeadMine.